Saturday, June 22, 2024

LIVE IN-PERSON WORKSHOPS

Specific Steps That You Should Implement Now:

FREE Educational Webinars for Married IRA and Retirement Plan Owners with Large Retirement Plans and/or IRAs

Register to attend 1, 2, or all 3 Free Workshops at:

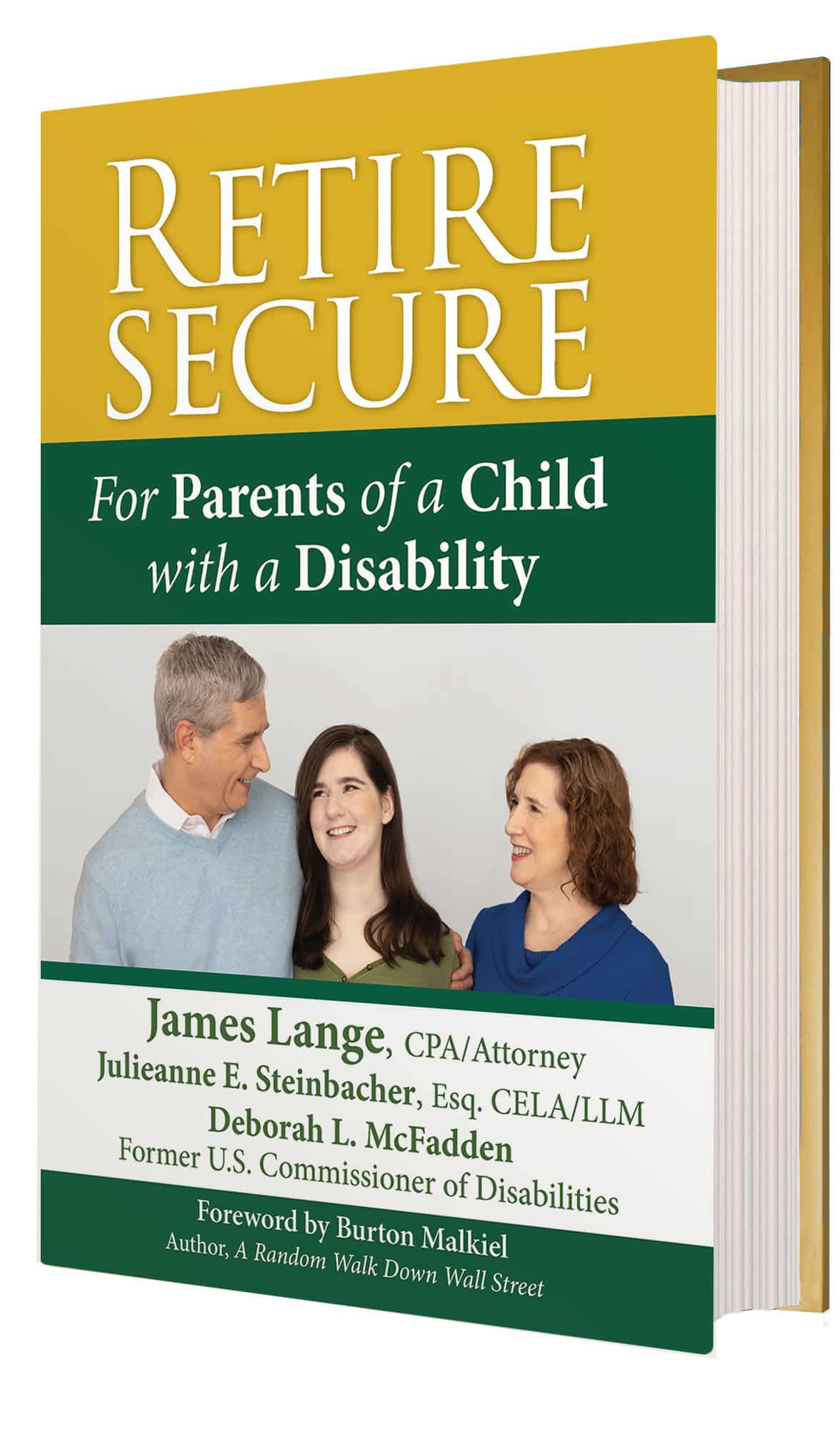

“Combining warmth and compassion with functional hard-headed advice, the dream team of Jim Lange, Deborah McFadden, and Julieanne E. Steinbacher have provided families of children with disabilities with the guidance they need to achieve financial security.”

―Burton G. Malkiel

Professor Emeritus of Economics, Princeton University and Author, A Random Walk Down Wall Street (Over 2 Million Copies Sold)

My co-authors and I believe you have discovered the best and most comprehensive financial resource available for parents of a child with a disability.

Our book explains, analyzes, and demonstrates how most parents can use very specific strategies to secure their financial life and the long-term financial life of their child.

Get your copy today by clicking here!